Robert McLister: Renewers, refinancers and prospective home buyers are anxiously Googling mortgage rates and terms

Article content

Mortgage-related searches on Google have hit an all-time high, second only to the chaotic March 2020 pandemic spike.

That’s notable because you never see this much mortgage interest in September. Mortgage searches typically peak in March or April as the spring homebuying season kicks off.

Something has changed, and that something is borrowing costs. Rate cuts are like donuts in the break room; irresistible. After the summer doldrums and three cuts from the Bank of Canada, mortgage borrowers are finally tempted.

Advertisement 2

Article content

But who’s behind this surge in interest? As we speak, three types of folks are anxiously Googling mortgage rates and terms.

Renewers

Many of these folks are coming out of fixed rates, some as low as 2.49 per cent, which they snagged five years ago.

Others have been languishing in variable rates around 5.60 per cent or higher — a relic of prime minus 1.10 per cent deals (give or take), also from five years back.

Yet others are coming out of one-year fixed rates, which were at least six to seven per cent in 2023 for a prime mortgage. Add at least a point or two for non-prime loans.

Some of these borrowers now face rates nearly double what they signed up for. Many are praying to the mortgage gods that Bank of Canada easing will lessen their interest burden.

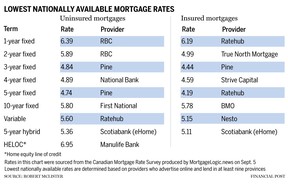

If you’re among those shopping for a renewal and are well-qualified, start with the lowest nationally advertised mortgage rates from this story’s accompanying table. Use them as leverage with your existing lender, and if they don’t play ball — and it’s worth your time and money — leave.

Refinancers

Canadians are buried under a record $2.41 trillion in household debt, according to TransUnion. Payment stress is rampant among a large minority of mortgagors.

Article content

Advertisement 3

Article content

To relieve that stress, hundreds of thousands of Canadians are frantic to refinance. Merging high-cost debt into their home loan can sometimes save hundreds, even thousands, monthly.

Those most stretched signed mortgages in 2021-22, when home prices went vertical. Adding salt to the wound, home values have since dropped from their winter 2022 peak, leaving many without the 20 per cent minimum equity needed to refinance.

Then there’s the “stress test” rate — those high qualifying rates that lenders make you prove you can handle. At 200-plus basis points above your contract rate, they make it much tougher for debt-ladden borrowers to get approved.

And we can’t forget prepayment penalties, which folks in less flexible mortgages have to pay to refinance before maturity. As short-term fixed rates decline — which they are now — fixed mortgage penalties rise.

Many borrowers are scouring Google and other online sources to tackle these problems. They’re also hunting for the lowest refinance rates.

Unfortunately, many are looking at the wrong rates, thinking they can qualify for the best prime lending offers. In reality, those with high debt-to-income ratios or lower credit scores are often relegated to non-prime rates, which are at least 100 to 200 bps higher than Canada’s leading offers. Non-prime rates also come with lender/broker fees starting around one per cent of the loan amount, which prime lenders don’t charge.

Advertisement 4

Article content

Prospective home buyers

September and October are typically average months for real estate, each accounting for 8.2 per cent of annual sales, according to senior economist Shaun Cathcart from the Canadian Real Estate Association. (If you’re curious, the peak is May at 10.5 per cent.)

A slew of people searching for mortgages want to buy a home. They’re watching as fixed mortgage rates fall to two-year lows. They instinctively sense that falling rates will combine with record population growth to juice home prices — especially for single-family homes.

Fun fact: Working age population growth was 3.6 per cent in June, a record in data going back to 1977. These folks have to live somewhere.

There’s a good chance the next few months could account for a higher-than-normal share of annual home sales as more home buyers qualify for mortgages (thanks to falling rates), incomes keep climbing and confidence grows that housing is on a surer footing. This comes despite terrible affordability and rising unemployment, the latter of which hurts renters more than home buyers.

Advertisement 5

Article content

Of course, what’ll really get buyers off the fence is rising prices. That creates the most psychological motivation of all.

To that end, “It wouldn’t be surprising that, as interest rates come down… you see some pickup in housing prices,” Bank of Canada governor Tiff Macklem acknowledged yesterday. “That could well happen.”

Market’s new dawn

Mortgage growth has languished in the three per cent range for the last year, far below the 6.2 per cent ten-year average. But tides are slowly turning, with near-record mortgage interest as a telltale sign.

Recommended from Editorial

By year end, if bond market projections hold, Canada’s prime rate will drop another half-point, population will surge another few hundred thousand, and housing supply won’t keep pace. This sets up the next 12 months for a potentially decent real estate market with fewer indebted borrowers — until home prices inevitably surge again.

Robert McLister is a mortgage strategist, interest rate analyst and editor of MortgageLogic.news. You can follow him on X at @RobMcLister.

Advertisement 6

Article content

Mortgage rates

The rates displayed below are updated by the end of each day and are sourced from the Canadian Mortgage Rate Survey produced by MortgageLogic.news. Postmedia and Imaginative. Online Inc., parent of MortgageLogic.news, are compensated by certain mortgage providers when you click on their links in the charts.

Click here for the lowest national mortgage rates in Canada right now

Flummoxed by the mortgage market? Robert McLister is here to help. In his weekly column for the Financial Post, the mortgage strategist will help readers navigate the complex sector, from the latest trends to financing opportunities they won’t want to miss.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content