To view previous releases, select one from the dropdown box:

Currently displaying information released on: September, 2024

EU AND EURO AREA CONSUMER PRICE INDEX, AUGUST 2024

Year-over-year (August 2024 vs August 2023)

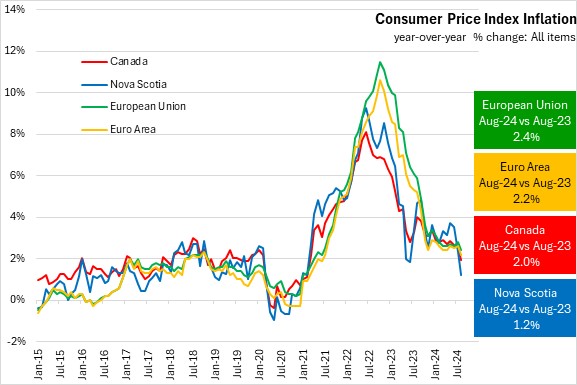

The inflation rate fell to 2.4% in the European Union and to 2.2% in the Euro Area in August 2024.

The fastest inflation was reported in Romania and Belgium while the slowest inflation rates were in Lithuania and Latvia.

Energy prices declined 2.1% in the European Union and 3.0% Euro Area in August 2024.

Food price inflation increased to 1.7% for the European Union and remained at 1.4% in the Euro Area in August 2024.

Excluding the impacts of energy, food, alcohol and tobacco prices year-over-year inflation declined to 3.0% in the European Union and to 2.8% in the Euro Area in August 2024.

Source: Eurostat; Eurostat Data

CONSUMER PRICE INDEX, AUGUST 2024

Year-over-year (August 2024 vs August 2023)

All items: Consumer prices in Nova Scotia slowed to 1.2%. The national average inflation was 2.0%. In Halifax consumer prices increased 1.5%.

All items excluding food and energy: Nova Scotia consumer prices outside of food and energy increased 1.7%. This was below the national average increase of 2.4%.

Month-over-month (August 2024 vs July 2024)

All items: Consumer prices in Nova Scotia fell 0.5%. Nationally, consumer prices declined 0.2% compared to the previous month. In Halifax consumer prices declined 0.4%.

All items excluding food and energy: Nova Scotia consumer prices excluding food and energy declined 0.3% month over month in August 2024. Nationally, consumer prices outside of food and energy edged down 0.1% from the previous month.

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted

ANALYSIS OF CONSUMER PRICE INDEX FOR AUGUST 2024

Nova Scotia’s all items Consumer Price Index (CPI) slowed to 1.2% year-over-year in August 2024, down from 2.3% year-over-year in July.

Nova Scotia’s inflation has been slowing after peaking at 9.3% in June 2022, though there have been periods of rising inflation, particularly on higher energy prices.

Nationally, consumer prices increased 2.0% year-over-year in August 2024, down from 2.5% in July. Inflation was highest in British Columbia and slowest in Saskatchewan.

The most significant upward contributors (combining price increase as well as share of the consumption basket) to Nova Scotia’s 1.2% year-over-year inflation were: rent, mortgage interest cost, food purchased from restaurants, electricity, and passenger vehicle insurance premiums.

The largest downward year-over-year contributions were from: Gasoline, traveller accommodation, fuel oil, women’s clothing and telephone services.

On a monthly basis, Nova Scotia’s all items CPI was down 0.5% from July to August 2024. National prices were down 0.2% with decreases reported for all provinces except Newfoundland and Labrador. New Brunswick reported the fastest percentage decline on a monthly basis.

Major upward contributors to Nova Scotia’s monthly consumer prices were: furniture, clothing accessories, watches and jewellery, passenger vehicle insurance premiums, mortgage interest cost, and personal care supplies and equipment. The main downward contributions were from: gasoline, inter-city transportation, telephone services, travel tours, and women’s clothing.

Energy prices play a significant role in inflation rates. Nova Scotia’s energy prices were down 5.4% from August 2023 to August 2024. Year-over-year energy prices were down 4.7% nationally with all provinces reporting lower energy prices. Alberta reported the fastest year-over-year decline in energy prices while Saskatchewan and Ontario reported the smallest decline.

On a monthly basis, Nova Scotia’s energy prices fell 2.4% from July to August 2024. National energy prices were down 1.6% with seven provinces (except British Columbia) reporting lower prices compared to the previous month. Prince Edward Island reported the largest monthly decline in energy prices. Saskatchewan reported the largest gain.

Nova Scotia’s energy prices (and overall inflation) are more sensitive to fluctuations in the global price of crude oil. In August 2024, gasoline prices were down 9.4% compared to a year ago in Nova Scotia. Eight provinces reported lower gasoline prices, with the steepest drop in British Columbia and Manitoba. Alberta and Saskatchewan reported the only gains in gasoline prices. Gasoline prices fell 3.9% from July to August in Nova Scotia (-2.6% nationally). All provinces except Saskatchewan and Manitoba reported monthly gasoline price declines with the largest decline in Nova Scotia.

Nova Scotia’s year-over-year fuel oil prices were down 10.5%. Nationally, the fuel oil and other fuels index declined 10.2% compared to August 2023. Newfoundland and Labrador reported the steepest drop, and Québec reported the smallest decline. On a monthly basis, Nova Scotia’s fuel oil prices were down 1.5%. National fuel oil prices were down 3.5% from July to August. Newfoundland and Labrador reported the steepest decline and Saskatchewan reported the smallest decline, while prices in Manitoba were virtually unchanged.

Food price inflation was 3.3% in Nova Scotia (August 2024 vs August 2023). National food prices increased 2.7% in August. Food prices were up in all provinces. New Brunswick and Newfoundland and Labrador reported the highest food price inflation while Québec reported the slowest food price growth.

On a monthly basis, Nova Scotia’s food prices decreased 0.4% from July to August. National food prices edged down 0.1% with seven provinces reporting lower prices on a monthly basis. The largest growth was in Newfoundland and Labrador and the largest decline was in Prince Edward Island.

Food and energy prices are heavily influenced by volatile global commodity markets. Nova Scotia’s underlying inflation rate excluding food and energy was 1.7% from August 2023 to August 2024. Nationally, inflation excluding food and energy was 2.4%. British Columbia and Alberta reported the fastest growth while Saskatchewan reported the slowest growth in inflation excluding food and energy prices.

On a monthly basis, Nova Scotia’s prices for all items excluding food and energy were down 0.3% from July to August 2024. Nationally, prices for all items excluding food and energy were down 0.1% with declines in eight provinces. Manitoba reported the fastest monthly decline while Prince Edward Island and Québec reported the only gains.

Year-over-year shelter cost inflation was 4.4% in Nova Scotia in August 2024, below the 5.8% shelter inflation reported in July. National shelter prices were up 5.3% with increases in all provinces. Québec and British Columbia reported the largest year-over-year increase in shelter prices while Prince Edward Island reported the slowest increase.

Monthly shelter costs were down 0.1% in Nova Scotia from July to August 2024. Nationally, shelter costs were up 0.4% with increases in six provinces, led by Newfoundland and Labrador. The largest drop was reported in Manitoba.

Among detailed food products with available data, Nova Scotia’s year-over-year inflation was fastest for fresh vegetables as well as eggs and pork. The largest year-over-year price decline was for sugar and confectionary.

In detailed shelter cost components, rent reported the fastest year-over-year price increase, followed by electricity. Fuel oil/other fuels and home maintenance/repairs cost reported the only year-over-year declines.

Household operations/furnishings costs were up 0.9% overall. The largest increase was for internet access services. Prices fell for telephones, paper/plastic/aluminium products as well as for, textiles, appliances, and utensils/tableware/cookware.

Clothing and footwear prices were down 8.0% year-over-year in August with declines in all sub-components except clothing accessories and jewellery and clothing materials and services.

Health and personal care costs were up 1.6% year-over-year on gains in all sub-components (except personal care supplies) led by personal care services.

Overall transportation costs were down 2.0% year-over-year in August. Vehicle insurance had the largest increase while gasoline had the largest decline.

Nova Scotia’s overall prices for recreation, education and reading were down 1.8% from August 2023 to August 2024 with the fastest decline in home entertainment equipment and services and the fastest increase for reading (excluding textbooks) compared to August 2023.

Nova Scotia’s prices for alcohol, tobacco and recreational cannabis were up 3.9% year-over-year with growth in all categories. Alcohol from licensed establishments had the largest increase, followed by beer from stores and Cigarettes.

Trends

Since the start of the Bank of Canada’s inflation-targeting monetary policy regime, inflation for all items has generally been in the 0-4% range. Periods of above target inflation are typically followed by periods of slow price growth or declines. The most recent acceleration in inflation was the strongest since the inflation-targeting era began, though this inflation has faded with tighter monetary policy and lower commodity prices.

Many of these periods of accelerated and slowed inflation are attributable to volatile commodity prices, especially energy prices. Once the more volatile commodity prices are excluded, inflation in Nova Scotia has largely been below 2% for much of the last 20 years. However, the recent rise in inflation through 2021-2023 spreads beyond commodity prices, resulting in the longest period under the Bank of Canada’s inflation-targeting regime with Nova Scotia’s CPI excluding food and energy above 3%. In August 2024, Nova Scotia’s inflation excluding food and energy has slowed to 1.7% year-over-year, the lowest inflation since March 2021.

The Bank of Canada examines ‘core’ measures of inflation that are intended to remove the effects of volatile components and capture underlying inflation trends that are more connected to capacity in the Canadian economy. Core measures of inflation may also indicate where all items inflation is headed.

Canada’s core measures of inflation remained mostly at or below the Bank’s target of 2% for over a decade prior to 2021. However, after prices accelerated in 2022, core inflation measures also started to rise, peaking at over 6% for the CPI-common measure before declining. Compared to the previous month, year-over-year core inflation measures in August 2024 were down for CPI-common, CPI-median, CPI-trim, and CPI-core: CPI-common (2.0%), CPI-median (2.3%), CPI-trim (2.4%), CPI-core (1.5%).

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted; Table 18-10-0256-01 Consumer Price Index (CPI) statistics, measures of core inflation and other related statistics – Bank of Canada definitions

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted; Table 18-10-0256-01 Consumer Price Index (CPI) statistics, measures of core inflation and other related statistics – Bank of Canada definitions

US CONSUMER PRICE INDEX, AUGUST 2024

The United States Consumer Price Index (not seasonally adjusted) for All Urban Consumers increased 2.5% year-over-year in August 2024, this was down from a year-over-year pace of 2.9% in July.

Compared to August 2023, the US energy price index declined 4.0%. The food index rose 2.1% and the shelter index was up 5.2% year-over-year.

The US CPI excluding food and energy rose 3.2% compared to August 2023.

Note: Canada and Nova Scotia August 2024 CPI figures will be released on September 17, 2024.

Sources: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted; US Bureau of Labor Statistics retrieved from the Federal Reserve Bank of St. Louis

AVERAGE RETAIL PRICES, JULY 2024

Statistics Canada makes available scanner data on prices collected for a range of food and personal care items. These prices are collected through point-of-sale (transaction) data obtained directly from Canadian retailers. The data represent commonly purchased items (which do change over time), but are not representative of the Consumer Price Index weights. Over time, products are rotated and quantity or quality July change. Comparisons of prices from one time period to another July reflect quantity and quality changes as well as price changes.

For the purposes of this analysis, the 110 items reported by Statistics Canada will be grouped into:

- Meat, fish, poultry and meat substitutes

- Dairy, eggs and substitute products

- Fruit (including canned and frozen products)

- Vegetables (including canned and frozen products)

- Grains, cereals, beans, legumes and nuts

- Sugar, juices, cooking oils, condiments and prepared foods

- Health and cleaning products

Beef and salmon are the most expensive of meat and seafood products while chicken and pork were less expensive. Nova Scotia’s prices for canned tuna, chicken breasts and meatless burgers had the largest percentage price premiums compared to the national average. Nova Scotia’s prices for certain beef products (stewing, rib cuts, ground) as well as chicken thighs were notably below national averages.

Over the last year (July 2024 vs July 2023), the consumer price index for all items in Nova Scotia excluding food increased by 2.2%. At the same time average weekly earnings across all Nova Scotia industries increased by 7.6%.

Over the last year, prices for chicken breasts, pork shoulder, pork loin and top sirloin of beef all grew faster than average weekly earnings. Several products reported year-over-year price declines in Nova Scotia – particularly beef striploin, bacon, canned tuna and canned salmon.

Dairy and egg prices were generally higher than the national average in Nova Scotia in July 2024 (exceptions: milk in 2 and 1 litre containers).

Compared with July 2023, most reported dairy prices have grown more slowly than average weekly earnings, with the exceptions of eggs and butter. Some products have reported year-over-year declines in prices: margarine, block cheese, yogurt.

Prices for reported fruits in Nova Scotia were all higher than the national average for similar products with the exception of frozen strawberries. The largest gaps (in percentage terms) were for fresh strawberries, oranges and bananas.

Many fruit prices have fallen in the last year and average weekly wage growth has outpaced all reported fruits. The largest price declines (in percentage terms) were for cantaloupe, lemons and canned peaches.

Almost all reported vegetable prices were higher in Nova Scotia than the national average in July 2024 (exceptions: carrots, cabbage). In percentage terms, the largest gap was for tomatoes.

Average weekly wage growth from July 2023 to July 2024 has outpaced price increases for most reported vegetables (exceptions: frozen french fries, romaine lettuce, onions, potatoes, sweet potatoes, avocados). Several vegetable products reported lower prices over the last year, led by squash and frozen spinach.

Nova Scotia prices for grain, cereal, nut, bean and legume products were higher than the national averages for all reported products except peanuts and tofu.

Over the last year, average weekly wages have grown faster than prices for all reported grain, cereal, nut, bean and legume products except dried lentils. Many grain, nut, bean and cereal prices fell in Nova Scotia over the last year, with the largest decline in the price of two kilograms of white rice.

Among prepared foods, condiments, cooking oils, fruit juices and sugar as reported by Statistics Canada, only pasta sauce and mayonnaise were less expensive in Nova Scotia than the national averages in July 2024.

Prices for olive oil have risen sharply in the last year, well outpacing growth in average weekly earnings. Price growth also outstripped wage gains for infant formula, ketchup and orange juize. There were notable year-over-year declines in prices for canola oil, vegetable oil and canned soup.

Of all products reported by Statistics Canada, infant formula (900 grams) has the highest transaction price based on the volume chosen. Nova Scotia infant formula prices were slightly higher than the national average in July 2024.

Prices for health/cleaning products were higher in Nova Scotia than the national average, with the exception of shampoo.

Over the last year, prices for health and cleaning products were mostly down (exception: deodorant). Laundry detergent prices were down most substantially.

Trends (July 2024 vs July 2019)

Food prices have been distorted in recent years by global market conditions following the pandemic and Russia’s invasion of Ukraine. Compared with July 2019, prices for many meat products have grown faster than average weekly earnings in Nova Scotia. The exceptions were: meatless burgers, canned tuna, canned salmon, shrimp, bacon, whole chicken, chicken drumsticks, pork (all cuts) and stewing beef.

Over the last 5 years, the prices of eggs, margarine and butter have all grown faster than average weekly earnings.

Over the last 5 years, most reported fruit prices have not grown as quickly as average weekly earnings (exceptions: fresh strawberries, oranges, canned pears, grapes).

Over the last 5 years, vegetable prices have outpaced wage growth for the following products: canned corn, canned tomatoes, frozen french fries, romaine lettuce, and fresh tomatoes.

Over the last 5 years, prices for many reported grain, cereal, bean, legume and nut products have outpaced growth in average weekly earnings (exceptions: sunflower seeds, peanuts, almonds, dry beans/legumes, canned beans/lentils, wheat flour, white rice, brown rice, cookies and flatbreads.

Over the last 5 years, prices for most reported foods in this category grew faster than average weekly earnings (exceptions: hummus, peanut butter, baby food, canola oil, vegetable oil, coffee, apple juice, frozen pizza).

Over the last 5 years, only deodorant prices grew faster than average weekly earnings in Nova Scotia among reported health and cleaning products.

Source: Statistics Canada. Table 18-10-0245-01 Monthly average retail prices for selected products; Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted; Table 14-10-0063-01 Employee wages by industry, monthly, unadjusted for seasonality