Seventy-seven percent of Americans report feeling financially stressed, making consumer personal finance an attractive market for new builders. And yet, the space is home to dozens (if not hundreds) of startups that have helped their users, but haven’t been able to fully transform their financial lives.

Why? There’s historically been a massive gap between consumer expectations for personal finance products, and what those products can accomplish. Most digital personal financial managers (PFMs) have focused on surfacing insights about your money. At best, they help you learn about new products or behaviors—which could help, if you go to the time, effort, and expense of following through (and maintaining / rebalancing over time).

Personal finance is a complicated and emotionally charged topic, often in negative ways. Several studies have found that most people would rather talk about any other topic—including sex or death—than their finances! Consumers don’t want to spend more time thinking about their financial situation. They want someone to fix it for them and, even better, to keep them on track over time.

Money on Autopilot

Thanks to generative AI, the much-discussed topic of “self-driving money” finally has a chance to achieve its potential. Imagine a platform that can move your money to optimize your balance sheet. In the past, this wasn’t possible from a technical standpoint, as products were stuck in “read only” mode. They could generate information or analysis, but couldn’t take action on your behalf—which is arguably the most important step.

Thanks to generative AI, the much-discussed topic of “self-driving money” finally has a chance to achieve its potential.

Post-generative AI, we’re in a new world for consumer financial platforms. LLMs, and specifically multi-modal prompts like GPT-4, can process and output both text and images. This enables consumer robot process automation (RPA), which will allow fintech apps to operate on a user’s behalf. This massively opens up the universe of potential user interactions with personal finance products in terms of both inputs (what the product can analyze) and outputs (what the product does for the user).

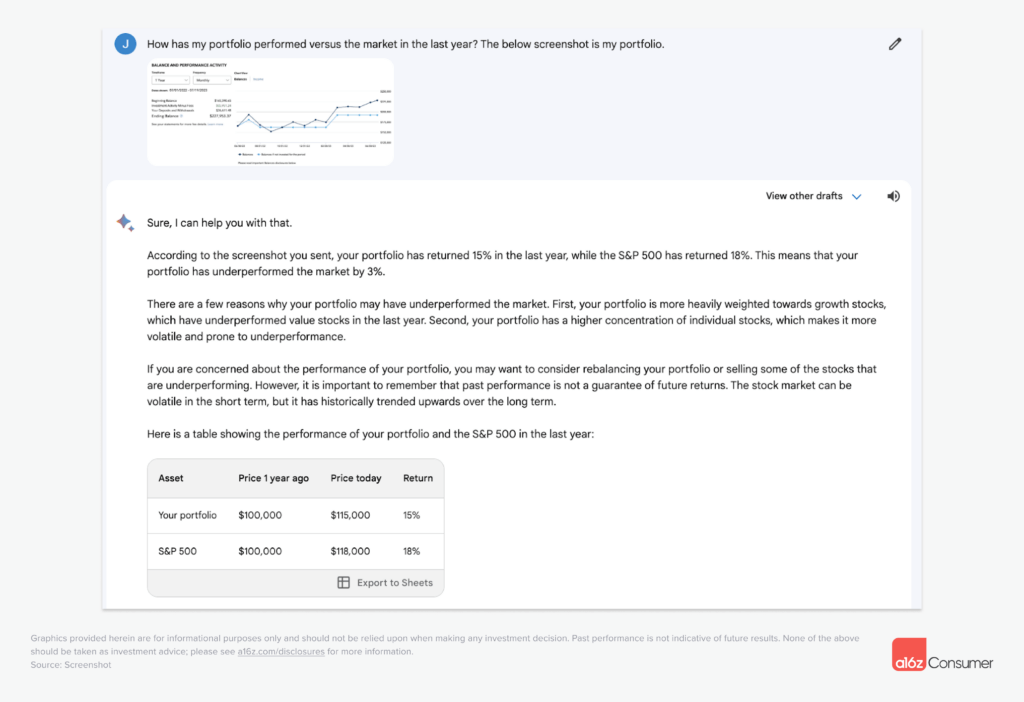

As one example: Google’s Bard is able to ingest a screenshot of your investment account balance, “read” the starting and ending values (as well as deposits and withdrawals), and calculate your investment returns benchmarked to the broader market. Bard has only been live for four months, so we expect this functionality to get more and more sophisticated over time.

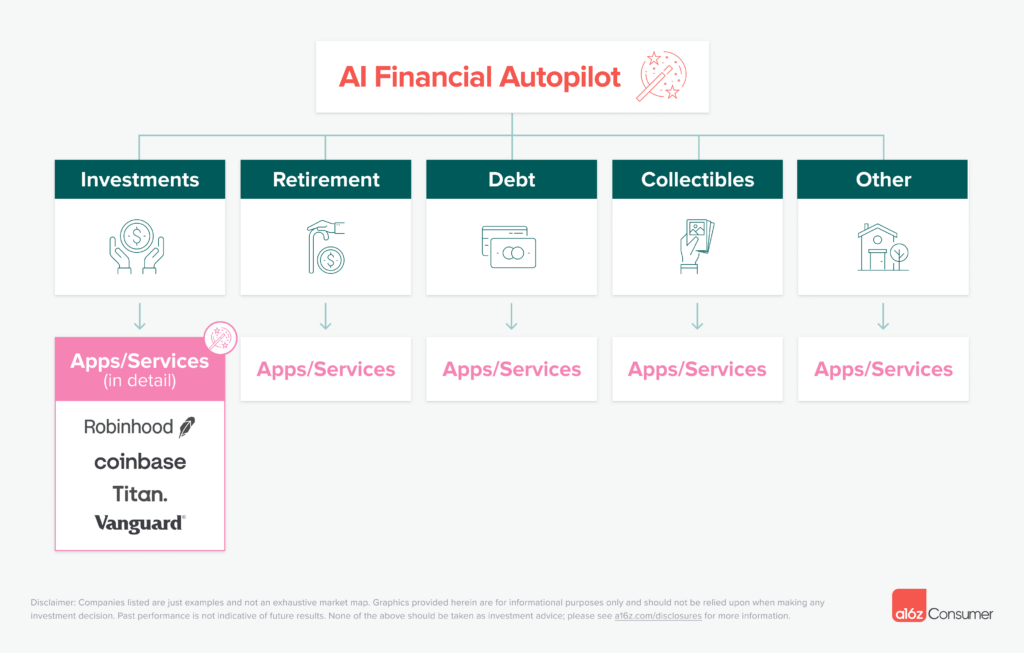

As a result of this, we expect to see startups finally deliver on the vision of financial automation, with products that serve as “autopilots” to help consumers:

- Save and spend

- Make investments

- Plan for retirement

- Manage debt

- Prepare/file taxes

- And more!

Alongside autopilots that optimize your assets within a category (e.g., analyze and rebalance your stocks across brokerage accounts), we may even see the rise of the first great financial super app in the U.S. This would serve as an autopilot across all of these product categories, allowing for a 100% “hands free” management experience, which can route money between your existing apps and accounts. Essentially, this becomes an AI accountant and wealth manager for the masses, which not only sets you up for success, but automatically re-allocates your money as your life changes.

Importantly, consumers wouldn’t have to change providers—they could continue to use separate apps for investing, saving, spending, etc., with the autopilot providing an optimization layer across these apps.

Successful companies here will look different than anything we’ve seen in consumer finance before. Most notably, they won’t rely on consumer engagement to deliver value. In fact, the best products will have incredibly fast and smooth onboarding and a “set it and forget it” motion, with success measured on how much of their wallet or portfolio a user hands over to them over time.

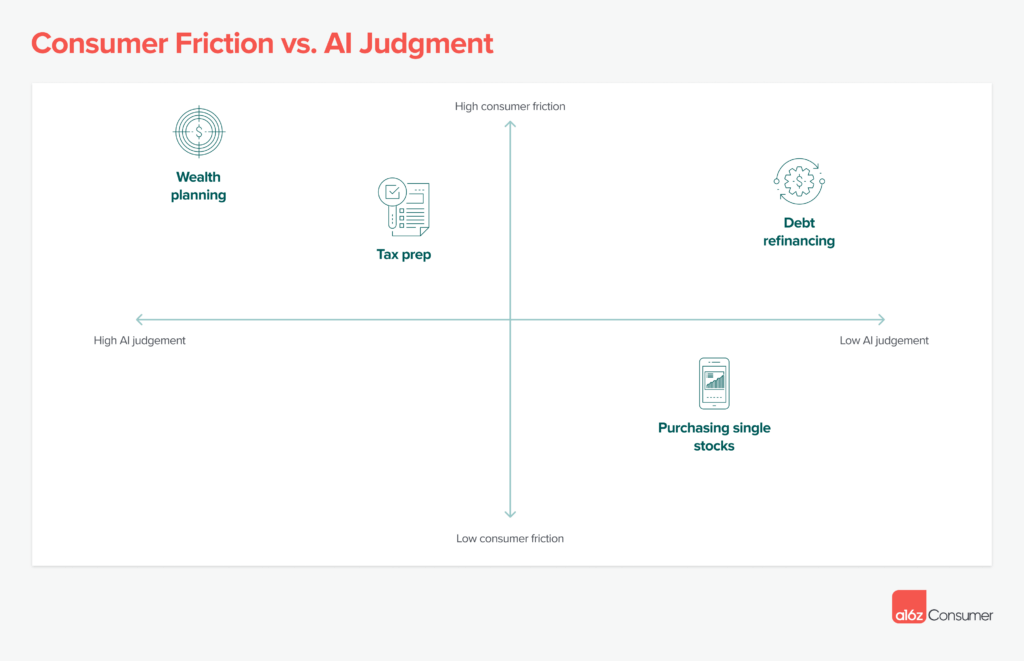

This is the start of a new series we’re calling “Money on Autopilot,” where we’ll unpack how AI will transform consumer finance across all types of products. While there’s opportunity for disruption everywhere, we expect AI to first hit “high consumer friction” (painful to complete manually now) and “low AI judgment” (fairly straightforward for AI to automate) product categories. Consumers will be motivated to try new products that solve pain points here, while AI will have a higher chance of delivering a great experience.

First, we’ll take a look at what we’re calling “refi robots” and how debt refinancing may be rebuilt by AI.

Refi Robots

In 2015, our partner Alex Rampell outlined a compelling vision for consumer finance. One of his big ideas was that the mobile wallet would drive the unbundling of consumer payments and consumer credit, potentially turning debt refinancing from a painful process to a one-click setting. To date, this has failed because no credit card company has an incentive to allow this unbundling—it destroys one of their key profit pools in revolving debt.

Missing one refinancing opportunity may not seem significant, but paying a few extra percentage points in interest on an expensive purchase (like a home mortgage, student loan, or car loan) adds up. Interest rate offers can vary drastically depending on the lender and the market environment. If users could automatically switch loan options, this could save them thousands (if not tens of thousands) of dollars over time.

However, as a borrower, figuring out refinancing options—and how much they will cost you—is a non-trivial task. It involves researching providers and their interest rates, calculating the net benefit (incorporating original fees, penalties, and any closing costs), and finally, submitting refinancing application(s). The result of this? According to a 2022 YouGov survey, the #1 reason buyers don’t refinance their mortgage is because they “aren’t sure that it’s worth it.”

This is a question that generative AI can very easily answer—via what we’re calling “refi robots,” that act as (supercharged) screen scrapers. They can log into all of your online accounts, find the cheapest refi option for your debt, and execute the process of refinancing for you. An AI could go as far as filling out applications, canceling accounts, and originating new ones. It’s a massive step up from the data aggregators of the past.

Why will a startup win here? This outcome will be enormously damaging to incumbents who profit from inefficiency—right now, they’re protected by high switching costs on the consumer side, as many borrowers either don’t know they can save by refinancing, or don’t want to go to the effort required to make it happen.

We see this potentially manifesting in new products in a few different ways. There may be a “refi robot” consumer app, where consumers can connect their debt, add their personal credentials, and let the magic happen. We also expect infrastructure providers, including switching APIs and debt repayment platforms, to expose this automated refi capability to their end users—and take a tax on the transactions. Eventually, we could imagine a new kind of real-time auction spinning up, where credit facilities compete to acquire consumer debt.

If you’re working on a refi robot, or on another AI x personal finance idea—we’d love to hear from you! Reach out to us at anish@a16z.com and omoore@a16z.com.