This section presents the results obtained based on the methodological framework described above. The first part identifies the articles excluded from the co-word analysis and provides an explanation for their omission. The second part analyzes the 4909 articles chosen to explain the conceptual structure and the thematic evolution of digital business research with its trending topics.

Digital business research from 1907–1998

Research literature on digital business during this period (1907–1998) was scarce, with only 36 articles identified (see Appendix A). This low number of publications reflects the nascent stage of the field, as the concept of “digital business” had not yet emerged as a distinct research area. The articles from this period mostly focused on innovative concepts that, while valuable in their time, were not directly related to digital business as we understand it today. The most common topics found in these articles included business rent, labor unions, cooperation, joint costs, and similar themes that were more relevant to traditional business studies.

Interestingly, although some articles mentioned keywords such as “Industry 4.0,” these references were not aligned with the modern interpretation of the term. In many cases, the mention of “Industry 4” was incidental, referring to page numbering or similar non-relevant contexts. This highlights a significant gap between the terminology used in early studies and the current understanding of digital business concepts.

The few articles that did include terms like “online business,” “entrepreneur,” “enterprise,” and “e-commerce” were excluded from our main corpus because they did not meet the criteria of containing at least two of the 26 predefined keywords. Even when terms like “e-commerce” appeared multiple times within an article, they were not considered for further analysis unless they were paired with additional relevant terms. This filtering process ensures that only articles that more closely align with the modern field of digital business are included in the study.

Comparative analysis

The growth rate of publications during this period was modest, with an annual increase of only 8%, corresponding to approximately 1.24 articles per year. This low publication rate is consistent with the general absence of digital business topics in the academic literature of the time. To better understand whether this low interest in digital business was an anomaly or part of a broader trend, we can compare this period to subsequent decades. While research on digital business in the 1999–2022 period has experienced exponential growth, driven by the rapid expansion of the internet, e-commerce, and digital technologies, the 1907–1998 period stands in stark contrast, with a focus on traditional business themes and limited awareness of the digital transformation that would later define the field.

By expanding the discussion of the 36 articles from the early period, we can conclude that the scarcity of digital business-related research in this time frame was not an anomaly but rather a reflection of the broader historical context. The low interest in digital business can be attributed to limited technological advancements and the absence of the internet and digital platforms, which later shaped the evolution of business practices. The comparatively slow growth of publications during this period, when viewed alongside the rapid growth in later years, underscores the shift from traditional business topics to the growing influence of digitalization on business models, strategy, and research.

Digital business research from 1999–2022

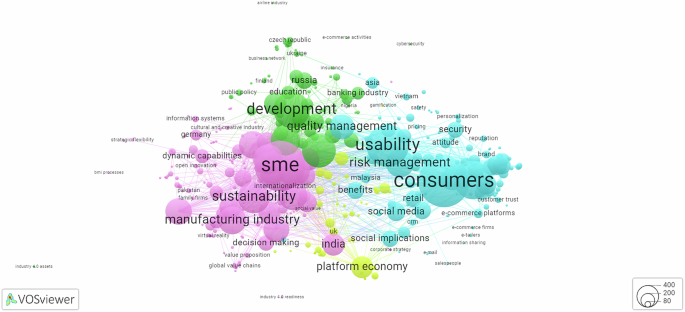

To identify the core themes of the selected articles from 1999–2022, we conducted a co-word analysis to explore thematic correlations. This analysis allowed us to cluster the articles into four key research communities: (1) Red: Digital transformation and sustainable business model innovation, (2) Green: E-commerce, consumer behavior, and experience, (3) Blue: Emerging technologies and economic development, (4) Yellow: The platform economy, and the future of work, as seen in Fig. 2 below.

We used a custom script built on the Tidyverse framework to analyze 4909 articles, focusing on the most frequent and relevant keywords. The co-word network consisted of 364 nodes and 9853 edges, from which we identified these thematic communities.

Community 1: Sustainability: Digital transformation and sustainable business model innovation

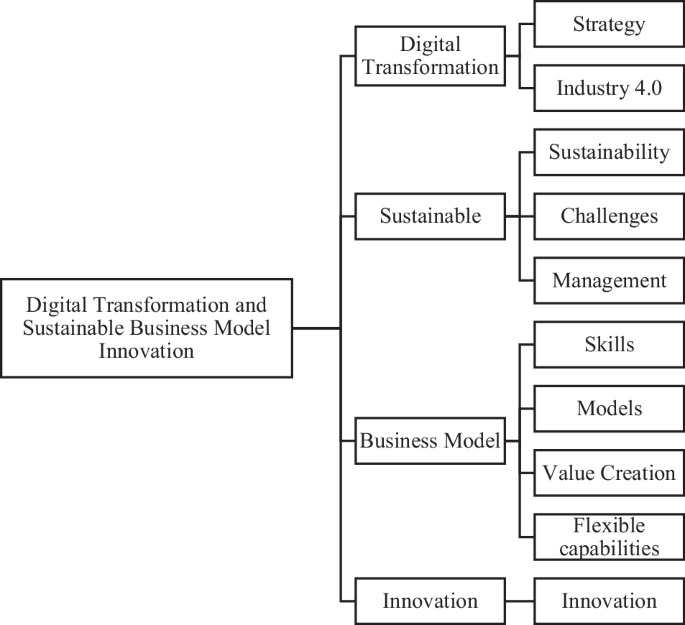

In this red cluster, the authors identified 168 keywords organized by their linkage weight, a measure indicating their connection in the literature. For a full list, see Appendix B. These keywords were grouped into thematic areas under umbrella words like Strategy, Industry 4.0, Sustainability, Challenges, Management, Skills, Models, Value Creation, Flexible Capabilities, and Innovation (see Appendix C for detailed classification).

Digital Transformation encompasses Strategy and Industry 4.0. Industry 4.0 drives the adoption of new technologies in manufacturing, improving performance and sustainability. It incentivizes the use of digital tools to enhance productivity and efficiency, reducing waste and emissions (McKinsey and Company, 2022). Digital transformation, as a strategic organizational change, integrates these technological advances to foster new products and services, reshaping business interactions (Feliciano-Cestero et al., 2023; Correani et al., 2020).

Sustainability is framed as Sustainable, incorporating challenges, management, and skills. This term reflects the growing field of sustainable decision-making, which balances social, financial, political, and organizational challenges (Faiz, 2023). It emphasizes long-term value creation that supports the well-being of current and future generations, integrating economic, social, and environmental performance (Geissdoerfer et al., 2017).

Business Model is a key theme that describes how firms capture and create value in markets. It includes concepts like Models, Value Creation, and Flexible Capabilities. Skills refer to the ability to perform tasks and find solutions, while Value Creation focuses on mutual benefits among stakeholders. Flexible capabilities are competencies developed through collective learning to adapt to dynamic market environments (Hafeez et al., 2002; Lavie, 2007).

Innovation stands as a theme of its own, embodying the adoption of novel approaches that enhance value in economic and social domains. It reflects a mindset of seeking new ways to do business and the generation of new products, services, and management systems (Teece, 2010; Crossan and Apaydin, 2010). Figure 3 illustrates how these umbrella words form broad thematic areas. Together, they define the cluster as “Digital Transformation and Sustainable Business Model Innovation.”

Sustainability, in this context, goes beyond profitability, encouraging businesses to assess their contributions to social, ecological, and economic wealth. In developing countries, digital technologies can drive productivity without the high costs and environmental impact experienced by developed countries. This makes sustainability a critical focus in this cluster, particularly in the context of evolving business models in emerging economies.

Community 2: E-commerce, consumer behavior, and experience

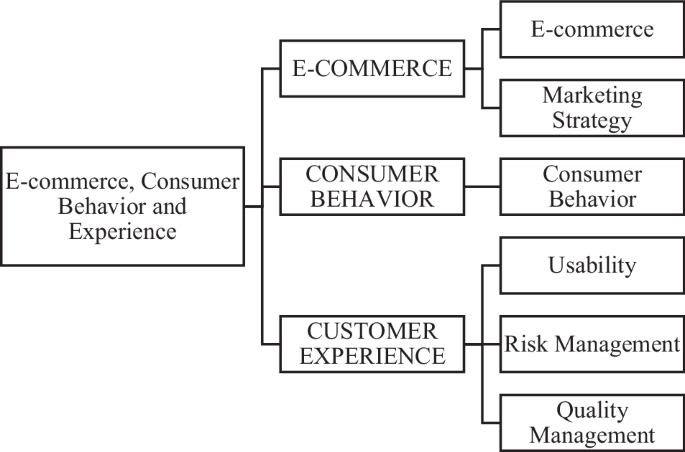

In this green cluster, the authors identified 111 keywords organized by their linkage weight. For a full list, see Appendix D. These keywords were grouped into thematic areas under umbrella words like E-commerce, Marketing Strategy, Consumer Behavior, Usability, Risk Management, and Quality Management (see Appendix E for classification).

E-commerce and Marketing Strategy were combined under the E-commerce theme. E-commerce refers to the delivery of goods, services, and information through digital channels, aiming to reduce costs and improve service quality (Kalakota and Whinston, 1997). Marketing strategy outlines the actions a company takes to achieve its goals, including targeting markets, creating value propositions, and implementing marketing programs (Morgan et al., 2019). Since e-commerce involves facilitating digital transactions, marketing strategy plays a key role in attracting customers. Consumer Behavior is a standalone theme due to its extensive research background. It refers to the decisions consumers make regarding the acquisition, consumption, and disposal of goods and services (Kajla et al., 2023).

Usability, Risk Management, and Quality Management were grouped under Customer Experience, as they relate to the user’s interaction with the product, trust, and the overall service experience. Usability measures how effectively users interact with a product, ensuring satisfaction and efficiency in achieving their goals (Hornbæk, 2006). Risk Management involves using data to identify and mitigate risks, ensuring operational safety (Cornwell et al., 2022). Quality Management is a managerial approach to improving both internal operations and external interactions, emphasizing the integration of technical and social aspects within the firm (Molina et al., 2006).

This cluster primarily references developing countries in Asia, except for Canada and Spain. Keywords related to retail, fashion, and hospitality industries were notably prominent, reflecting Asia’s leadership in these sectors. Figure 4 shows the thematic grouping of umbrella words. This aggregation led to the name of the cluster: “E-commerce, Consumer Behavior and Experience.”

Community 3: Emerging technologies and economic development

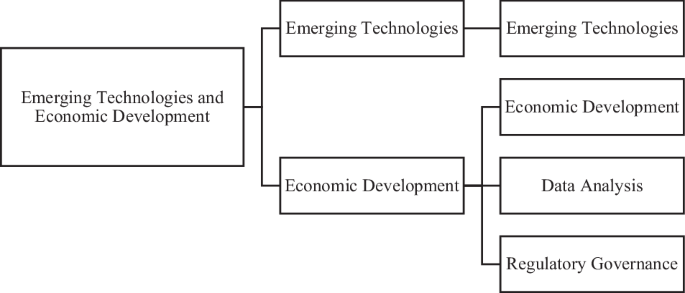

In this blue cluster, the authors found a total of 72 keywords between umbrella topics, themes, topics, and new concept words. For a detailed list of these words and their linkage weight, see appendix F. The authors needed to classify these words into small groups in order to identify the thematic areas of study and ultimately define the name of the area of study of this third cluster. Appendix G shows the classification of words.

The umbrella words identified by the authors within this cluster are emerging technologies, economic development, data analysis, regulatory governance, and situation. The final thematic name of the cluster, “Emerging Technologies and Economic Development,” reflects the broad impact of these areas.

Emerging Technologies refers to innovations such as artificial intelligence, machine learning, automation, and blockchain, which are reshaping industries across sectors (Rotolo et al., 2015). These technologies have rapidly advanced, and their full impact, particularly in societal and economic sectors, is expected in the future.

Economic development includes concepts like growth, education, labor productivity, and involves the use of emerging technologies to stimulate new markets, government regulations, and investments (Adelman, 2000). This expansive theme also integrates data analysis and regulatory governance, emphasizing the role of technology in fostering sustained economic growth and social progress (Brown, 2014; Levi-Faur et al., 2021).

A significant aspect of this cluster’s focus is on Europe, where avant-garde legislation has made the region a leader in digital technology practices. The Lisbon Strategy and subsequent Digital Agenda for Europe set ambitious goals, fostering a competitive and dynamic economy through the integration of digital technologies (Centre for Public Impact, 2022; European Commission, 2022; European Parliament, 2023).

The cluster also shows a clear link to the COVID-19 pandemic. The pandemic accelerated the global shift to digital technologies, leading to a surge in data flow and new research on virtual interactions and their real-world implications. As countries and organizations adapted to the crisis, researchers focused on understanding the economic shockwaves, the use of digital tools for managing the pandemic, and how emerging technologies could aid in recovery. This increased focus on data analysis and regulatory governance during the pandemic is reflected in the high linkage weight of COVID-19-related keywords in this cluster.

Ultimately, the cluster reflects the intersection of emerging technologies, economic development, and the transformative impact of the COVID-19 pandemic, reshaping research on how technologies drive economic resilience and societal development (Fig. 5).

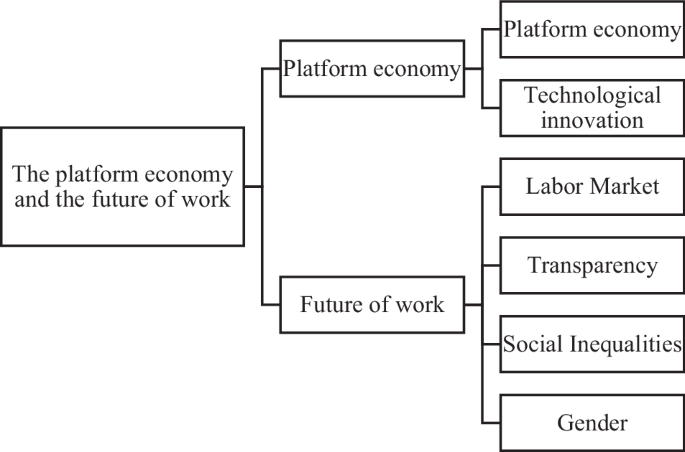

Community 4: The platform economy and the future of work

In this yellow cluster, the authors found a total of 58 keywords between umbrella topics, themes, topics, and new concept words. For a detailed list of these words and their linkage weight, see Appendix H.

According to the conceptual structure of the digital business research seen in Fig. 2, this cluster is the least developed so far. This gives the authors the idea that this cluster contains the most prospective topics and technological innovations, soon to be developed in the coming years. This idea corresponds with the geographic area of research of this cluster because the developed countries are the ones with the most available resources to create new technologies and innovative ways of applying them to the world of work and business.

To continue with the analysis, the authors began to classify the words into small groups of keywords of relatively similar meaning or close application. Appendix I shows the classification of words.

This cluster is still in the early stages of development, suggesting that it represents emerging trends that will be more pronounced in future research. The keywords identified—platform economy, technological innovation, labor market, transparency, social inequalities, and gender—all point to fundamental changes in how work and business will evolve in the digital age.

The labor market is undergoing shifts due to automation and artificial intelligence, displacing unskilled and middle-skilled workers, while prompting discussions around social inequalities, gender equality, and transparency in corporate and governmental operations (Bernstein, 2017; Rietveld and Patel, 2022; Our Economy, 2017). The future of work research stream explores issues such as workplace relations, diversity, and the skills needed in evolving environments (Gender, 2023; Mitchell et al., 2021). The pandemic also played a role in reshaping workplaces, with robotics and international migration being key topics in recent studies.

This cluster is heavily represented in developed countries, particularly those in the OECD, G20, and the Commonwealth, which are the primary regions leading research into platform economies and technological innovation. The platform economy connects suppliers and consumers in novel ways, with technological innovation being central to this shift, marking a significant research frontier for the next few years (Statistics Finland, 2019) (Fig. 6).

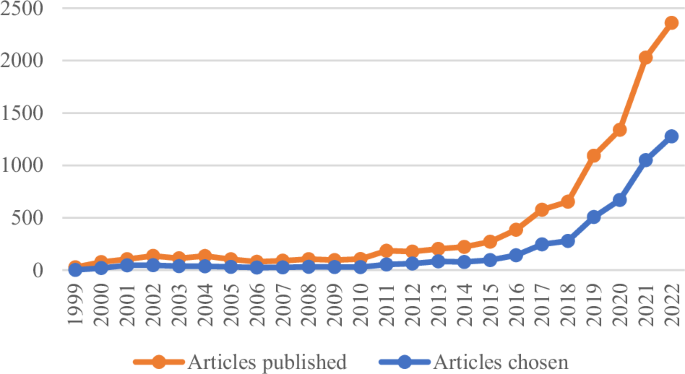

The evolution of digital business research from 1999–2022

This timespan could be divided into three subperiods of global market shocks that may have influenced the proliferation of digital business articles: (i) the Dot-Com bubble, (ii) the Great Recession, and (iii) COVID-19. These crises or shocks hold pivotal significance in technological transformation and related research, as highlighted by Hershbein and Kahn (2018). During prosperous times, elevated opportunity costs or hurdles such as adaptation expenses might hinder the optimal reallocation of resources amid technological alterations. Conversely, recessions diminish the opportunity cost and have the potential to generate sufficient shocks to navigate through these impediments (Hershbein and Kahn, 2018). This gives us notions about some of the main reasons for the fluctuation, stagnation, and increase of interest, reflected in the number of publications per year.

Digital business research on the dot-com bubble (1999–2007)

Appendix J shows the time when the dot-com bubble grew and then the decrease in volatility after the capitulation in mid-2000. This period has two parts. The first part of this period shows an increase in the number of publications, corresponding with the growing interest in the stock market in dot-com firms. In this part of the period, there is an average growth rate of publications per year of 317.50%, which corresponds to an average of 52.50 publications per year. The second part corresponds to the following years after the implosion of the market value of many stocks from startups that were growing before becoming profitable. In this particular subperiod, there is an average growth rate of publications of 4.99% per year, which corresponds to an average of 109 publications per year. It was an evident increase, but not as high as the first subperiod.

It is interesting how the number of publications grew between 1999 and 2002, then stagnated between 2002 and 2004, and then started to decrease.

Coincidentally, the boom of internet companies is reflected in the boom of publications about digital businesses.

Extraordinary overinvestment in the so-called new technology sector in the late 1990s, and its capitulation in 2000… Many financial analysts were beginning to believe the idea that stock market valuations were no longer driven only by traditional economic factors such as earnings growth, inflation, and interest rates. Instead, they began to suggest that new factors such as the value of intangible assets and brands warranted the haughty stock prices. During this time companies, including Amazon, Pets.com, and Buy.com, spent investors’ money trying to become big before they became profitable. Very few went well. Inevitably, growth without profitability could not be sustained indefinitely, and in the spring of 2000, there was a ‘capitulation’ of the Internet sector—a sudden and final wave of selling of Internet stocks that sent the market down far enough and quickly enough to wipe out all investor optimism for the Sector—which eliminated all, so-called, ‘irrational exuberance’. [(Wheale and Amin, 2003). page 119].

Since the inclusion criteria for articles is to have two or more of the 26 keywords within or between the abstract, title, and/or author keywords, this period included 272, out of 868 articles from WoS and Scopus. See appendix J.

Digital business research in the great recession (2008–2019)

Appendix J shows the fluctuations in the number of publications between 2008, the year when the Great Recession started to spread around the world, and 2019, the year prior to the recent pandemic. This period has two parts. The first subperiod shows an increase in the number of publications, with an average growth rate of publications per year of 4.05%, which is not as high as the previous period of the post-dot-com bubble. There are 100.5 publications per year, which is not as different from the second subperiod of the previous years. The second part of this period corresponds to the following years after the declared financial crisis of the subprime mortgage collapse. In this particular subperiod, there is an average growth rate of publications of 29.91% per year, which corresponds to an average of 387.1 publications per year. It was an evident increase, which responded to the needs of the markets and governments to better control and regulate the value of assets in banks. It could be thought that this need for technology to account for all assets and debts in the financial sector incentivized the creation or improvement of better technological tools.

Since the inclusion criteria for articles are to have two or more of the 26 keywords within or between the abstract, title, and/or author keywords, this period included 1640 out of 4072 articles from WoS and Scopus. See appendix J.

Digital business research on the COVID-19 era (2020–2022)

Appendix J shows the number of publications about digital business during the period 2020–2022. This is a peculiar timespan because it corresponds to the time when COVID-19 made all governments worldwide declare lockdowns. This shock was an incentive for the use of digital communication technologies to replace previous forms of connection or communication. As such, it became fertile ground for the innovative adaptation of technologies to resume the flow of information and transactions between companies, despite the prohibition of leaving households or holding physical meetings. These innovations forced the belief that employees could work remotely, and customers could be served virtually. All these changes made it possible for researchers to also pay attention to the technological changes in industries, organizations, firms, and households, and their resilient interactions during the pandemic. In this period, the average growth rate of publications per year was 30.15%, and the average number of publications per year was 1909, which are higher statistics than in any other previous period identified in this study.

Since the inclusion criteria for articles are to have two or more of the 26 keywords within or between the abstract, title, and/or author keywords, this period included 2997 out of 5727 articles from WoS and Scopus. See Appendix J.

Figure 7 shows the publication trends of this research. As Appendix J indicates, digital business research has had four main waves in the business and economics fields. In the first wave (1907–1998), the topic garnered limited attention with only a few articles published. During the second wave (1999–2014), coinciding with Talafidaryani et al. (2023), the number of publications increased slightly, probably mainly due to the dot-com bubble. After that, there was a third wave that became strong after the Great Recession. Finally, the 4th wave, in which we are publishing this article, is where the interest in digital business became a public necessity due to the COVID-19 lockdowns. This indicates a remarkable progression in the evolution of digital businesses, which has given momentum to the development of more topics like digital innovation and digital transformation in the fields of business and economics, as well as in the information systems field.

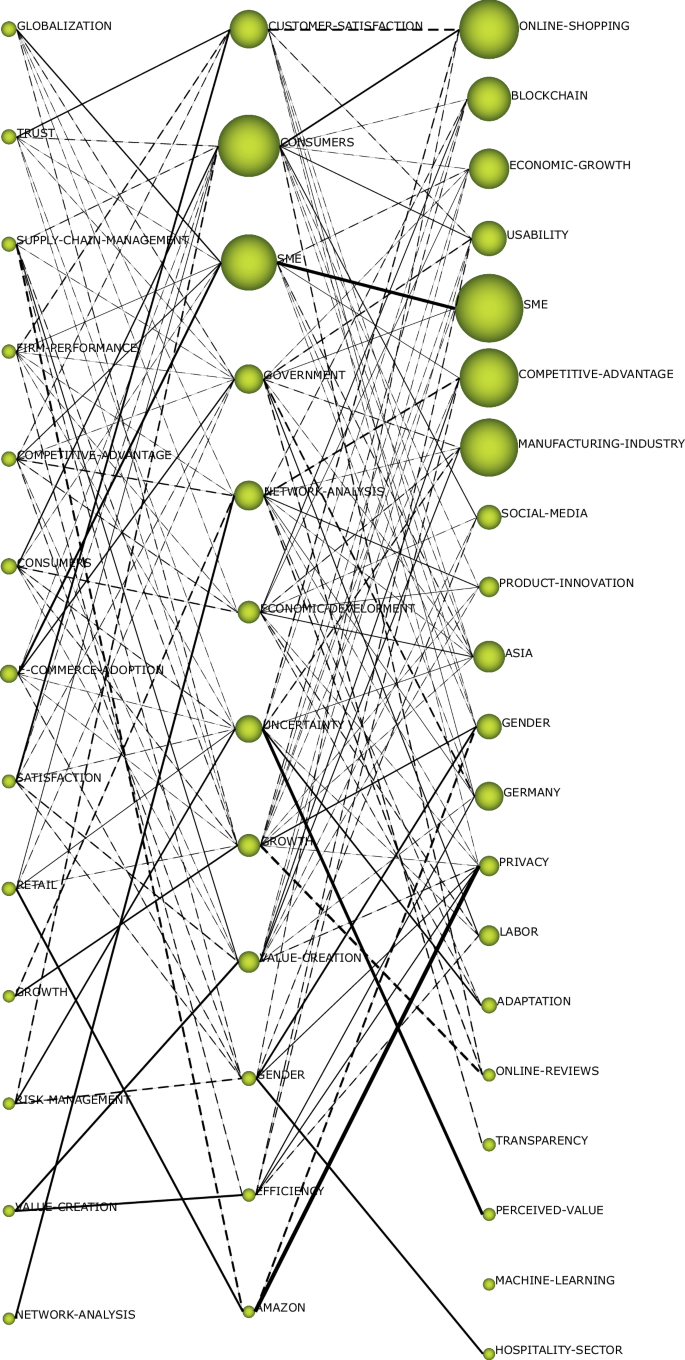

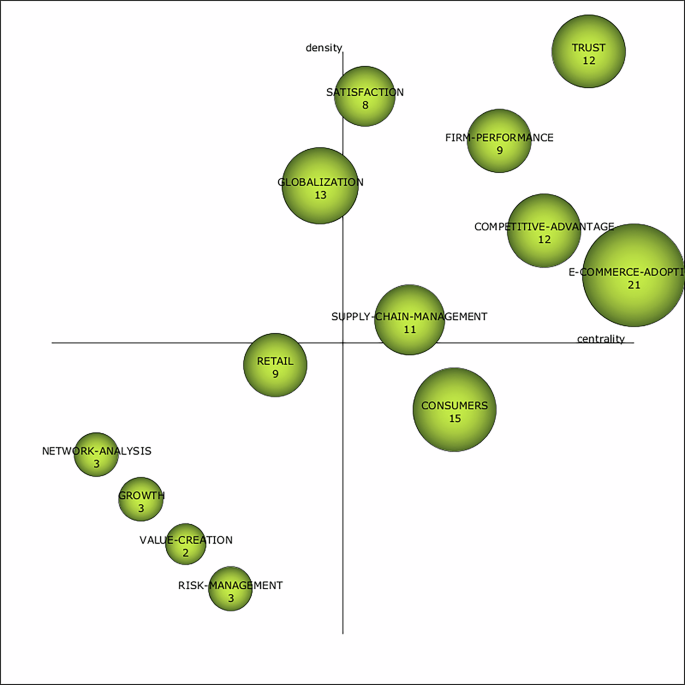

Thematic evolution of digital business research

The evolution map (Fig. 8) reveals the progression of key themes in digital business research across three periods. Cluster size corresponds to the number of documents, while lines between clusters indicate thematic links based on topic co-occurrence. Solid lines denote consistent thematic connections; dashed lines, secondary themes. Line thickness reflects the inclusion index, indicating thematic commonality.

Persistent themes

-

SMEs: Evolved from the second period, linked to “globalization” and “e-commerce adoption.” By the third period (2020–2022), SMEs became central, emphasizing their role in economic growth via digital technologies.

-

Competitive advantage: Present from the beginning, declined during the second period, but reemerged as a key theme in the third.

Evolving themes

-

Value creation: Prominent in the first two periods, it integrated “government,” “uncertainty,” and “economic development” in the third, forming the “Manufacturing Industry” theme.

-

Online shopping: Developed from themes like “trust” and “satisfaction” into a focus on “consumers” and “customer satisfaction.”

Emerging themes

New topics in Fig. 8 include:

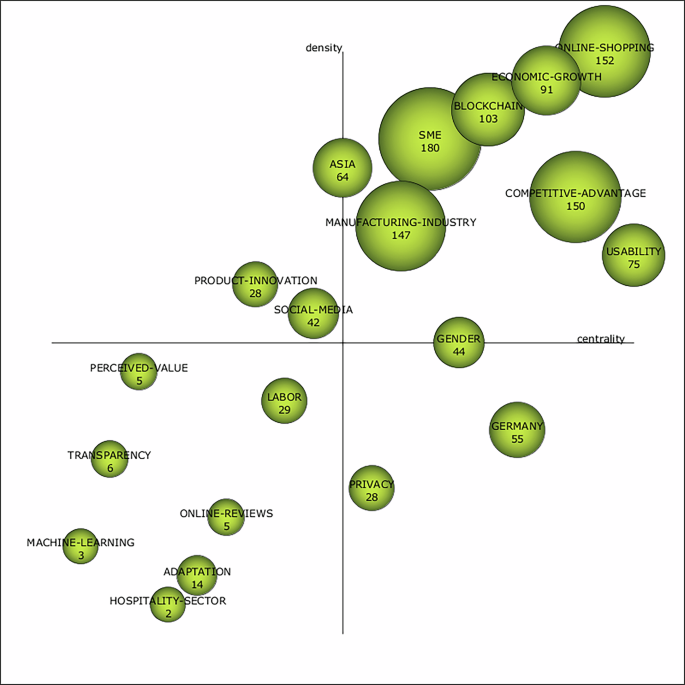

Strategic diagrams and motor themes

Figures 9–11 analyze theme centrality and density. The third period (Fig. 11) highlights motor themes:

-

SMEs (180): Focused on e-commerce, globalization, and government support.

-

Online shopping (152): Explores consumer trust, satisfaction, and uncertainty.

-

Competitive advantage (150): Studies differentiation, big data, and efficiency.

-

Manufacturing industry (147): Examines value creation, supply chain, and uncertainty reduction.

-

Blockchain (103): Analyzes secure transactions and economic development.

-

Economic growth (91): Links government, consumers, and macroeconomic trends.

-

Usability (75): Emerges from risk management and efficiency.

-

Asia (64): Highlights regional development in global markets.

-

Gender (44): Focuses on inclusion and economic opportunity.

Transversal and declining themes

-

Germany (55): Represents advanced manufacturing and efficiency.

-

Privacy (28): Gains relevance due to widespread data management concerns.

-

Labor (29): Reflects AI’s impact on workforce automation.

-

Adaptation (14): Demonstrates technological disruption.

-

Transparency (6) and Machine learning (2) are nascent but pivotal.

Isolated themes

Systematic comparison of thematic evolution in digital business research

A systematic comparison of the thematic evolution across the three identified periods—the Dot-Com Bubble (1999–2007), the Great Recession (2008–2019), and the COVID-19 Era (2020–2022)—reveals significant variations in the centrality and density of key themes, reflecting their changing roles in digital business research over time. Centrality refers to the degree of external interactions of a theme within the research field, while density assesses its internal cohesion and maturity.

Changes in centrality

During the first period (1999–2007), themes such as “Competitive Advantage” and “SME” exhibited high centrality, reflecting their pivotal role in shaping early digital business research. The surge in publications during the Dot-Com Bubble emphasized concepts like “value creation” and “trust,” which were essential for understanding the nascent e-commerce environment. These themes were deeply interconnected with topics like “globalization” and “e-commerce adoption,” showcasing their relevance to the broader field.

In the second period (2008–2019), the financial crisis brought new focal points, such as “Economic Development” and “Risk Management,” which gained higher centrality. The need for technological solutions to ensure financial stability and operational resilience during the Great Recession elevated these themes. Meanwhile, “Competitive Advantage” saw a slight decline in centrality as researchers diversified their focus to incorporate themes like “Supply Chain Management” and “Big Data.”

In the COVID-19 Era (2020–2022), themes like “SME,” “Online Shopping,” and “Manufacturing Industry” became central themes. “SME” gained renewed prominence due to the emphasis on digital transformation for small businesses, while “Online Shopping” surged due to global lockdowns. Additionally, newer themes like “Blockchain” and “Machine Learning” showed increasing centrality, signifying their growing importance in the digital business ecosystem.

Changes in density

The density of themes evolved alongside centrality, reflecting their development and consolidation within the research field. During the first period, themes such as “Trust” and “Satisfaction” had relatively low density, indicating their emerging nature and fragmented exploration. As digital business research matured, these themes evolved into more cohesive topics like “Customer Satisfaction” and “Risk Management” in the second period.

In the second period, “Supply Chain Management” and “Economic Development” exhibited high density, highlighting their internal cohesion and established methodologies. This period also saw the emergence of “Big Data” as a dense theme, driven by advancements in data analytics and their applications in improving business efficiency and decision-making.

In the COVID-19 Era, themes like “SME” and “Online Shopping” demonstrated high density, reflecting their maturity as essential areas of study. On the other hand, emerging themes such as “Transparency” and “Machine Learning” displayed lower density, indicating their nascent stage and potential for further exploration.

Evolution and decline of themes

Certain themes evolved significantly across periods. For example, “Value Creation” transitioned from a focus on profitability and growth in the first period to incorporating elements like “Government” and “Uncertainty” during the second period, eventually evolving into “Manufacturing Industry” in the third period. Similarly, “Online Shopping” evolved from themes like “Trust” and “Customer Satisfaction” to become a central research topic in the COVID-19 Era.

Conversely, some themes diminished in prominence. “Social Media,” which gained attention in the second period for its potential in marketing and consumer engagement, saw reduced focus in the third period due to privacy and security concerns. Likewise, “Product Innovation,” initially linked to economic development, shifted towards niche applications and lost its central position.

Understanding these changes in centrality and density helps identify potential directions for future research. Themes with high centrality and density, such as “SME” and “Online Shopping,” are likely to remain critical. Emerging themes like “Machine Learning” and “Transparency” offer fertile ground for exploration, especially as digital business technologies continue to evolve. Finally, revisiting declining themes with new methodologies or perspectives could provide fresh insights, ensuring the continued development of digital business research.