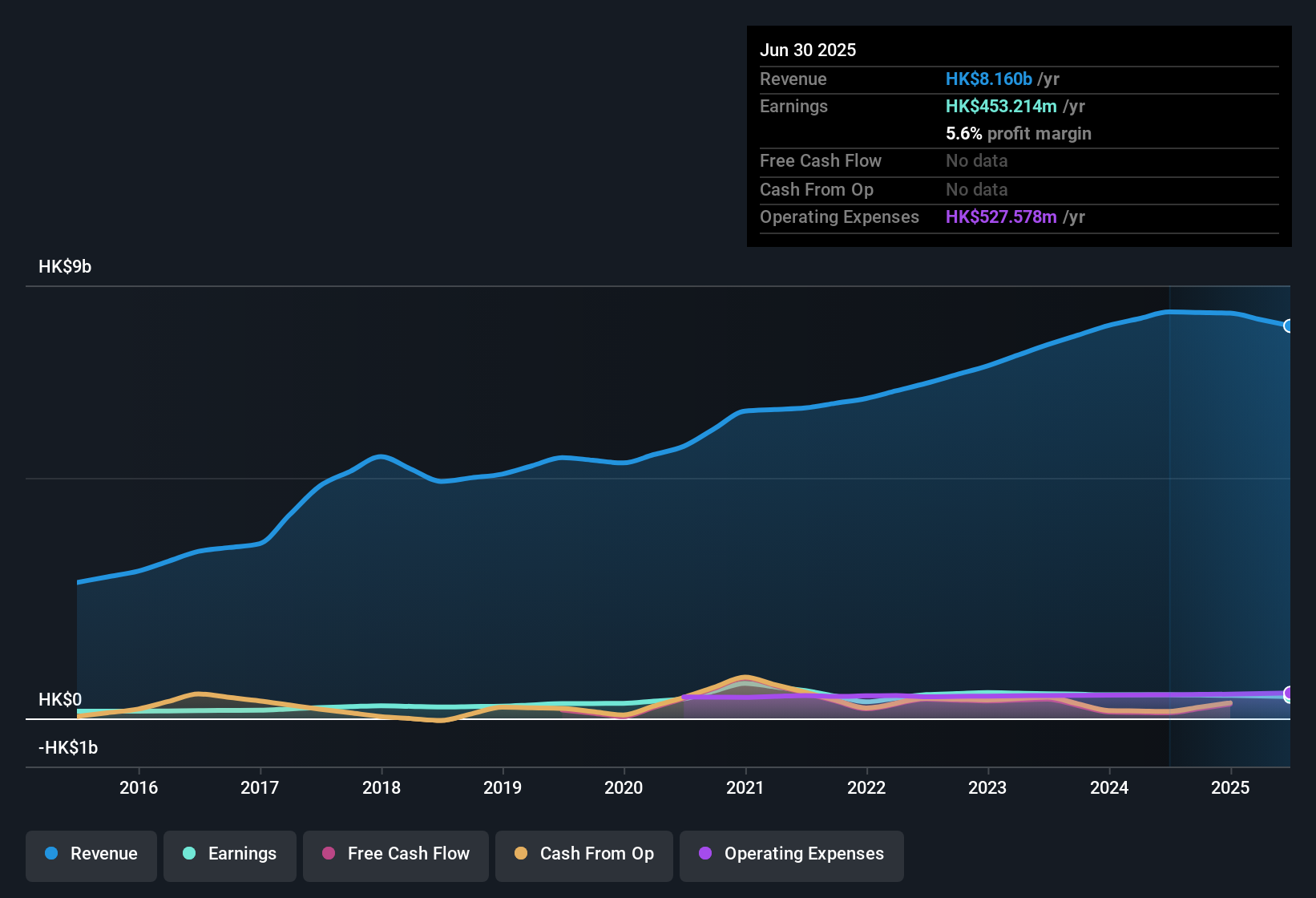

FSE Lifestyle Services (SEHK:331) enters the earnings season trading at a Price-to-Earnings Ratio of 5.9x. This is considerably lower than its peer average of 50x and also below the Hong Kong Construction industry average of 10.3x. Despite its share price of HK$5.9 sitting under the estimated fair value of HK$13.22 based on discounted cash flow analysis, the company has seen negative earnings growth over the past year following a track record of high quality earnings.

See our full analysis for FSE Lifestyle Services.

With the earnings headline set, the next section explores how these results compare with the most widely followed narratives around FSE Lifestyle Services. This highlights where the numbers challenge or reinforce investor sentiment.

Curious how numbers become stories that shape markets? Explore Community Narratives

Dividend Cut Draws Attention

- The company has not sustained its dividend, signaling a change from previous payout patterns highlighted in the filing.

- Critics highlight that a cut or halt in dividends typically questions management’s confidence in near-term cash flow stability and may reflect a defensive posture in response to falling earnings, reinforcing caution as flagged in the risks section.

- Bears argue that when a company historically known for stable payouts stops its dividend, it weakens the case for investors relying on income, especially since earnings have turned negative over the last year.

- What is surprising is that this shift has come despite the stock trading well below DCF fair value, which would normally encourage signaling strength through continued distributions.

P/E Discount Versus Peers

- FSE Lifestyle Services trades at a Price-to-Earnings Ratio of 5.9x compared to the peer group’s 50x and the Hong Kong Construction sector average of 10.3x.

- Despite the sizable discount, prevailing market view notes that negative earnings growth challenges the idea that valuation alone is a reason to buy.

- The low multiple could be a clear value signal; however, recent performance means the market may still be waiting on evidence of a turnaround before closing the valuation gap.

- Investors weighing the DCF fair value of HK$13.22 (substantially above the current price of HK$5.9) must also consider the deterioration in earnings momentum that has materialized over the past twelve months.

No Confirmed Growth Outlook

- The company provides no confirmation that revenue or earnings are expected to grow in coming periods, according to the latest filing and risk disclosures.

- Prevailing market view interprets the silence around forward-looking growth as a material headwind for bullish investors looking for a clear turnaround catalyst.

- While value is on offer relative to sector multiples and intrinsic estimates, the absence of formal guidance means that any recovery is speculative rather than a matter of confidence or visibility.

- This uncertainty makes it harder for investors to justify a rerating or increased exposure, even as the share price sits at a steep discount to calculated DCF fair value.

Have a read of the narrative in full and understand what’s behind the forecasts.

Next Steps

Don’t just look at this quarter; the real story is in the long-term trend. We’ve done an in-depth analysis on FSE Lifestyle Services’s growth and its valuation to see if today’s price is a bargain. Add the company to your watchlist or portfolio now so you don’t miss the next big move.

See What Else Is Out There

FSE Lifestyle Services faces rising uncertainty after cutting its dividend, reporting negative earnings growth, and providing no clear guidance for recovery.

If you’re looking for income resilience and confidence in payouts, check out dividend stocks with yields > 3% to spot companies with stronger and more reliable dividend track records as well as stable prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com