- Earlier this month, Hilton announced the launch of its 25th brand, Outset Collection by Hilton, expanding its lifestyle hotel lineup, and also celebrated the recent opening of The George at Columbia, a new Tapestry Collection hotel in Harlem featuring 139 rooms and several upcoming amenities.

- These developments highlight Hilton’s push into boutique and independent hotel experiences, aiming to broaden its customer base and increase its footprint in emerging urban and culturally significant neighborhoods.

- Next, we’ll explore how Hilton’s brand expansion and new Harlem property could reinforce its investment narrative focused on pipeline growth and lifestyle offerings.

Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

Hilton Worldwide Holdings Investment Narrative Recap

To be a Hilton shareholder today, you generally need to believe in the company’s ability to grow through brand innovation, lifestyle offerings, and global pipeline expansion, with recovery in RevPAR and resilience in key demand segments as pivotal short-term catalysts. The recent launches of Outset Collection and The George at Columbia reinforce Hilton’s focus on high-value urban markets and experiential stays, but these announcements do not materially change existing risks tied to sector RevPAR softness and potential demand shifts.

Of the latest announcements, the launch of Outset Collection stands out as directly aligned with Hilton’s push into the lifestyle segment, which is one of investors’ clearest growth catalysts. This further broadens Hilton’s capacity to appeal to travelers seeking unique experiences, supporting pipeline momentum and Hilton Honors loyalty engagement at a time when competitive intensity and capital allocation risks remain elevated.

However, investors should also be alert to one critical factor: any prolonged softness in RevPAR that may…

Read the full narrative on Hilton Worldwide Holdings (it’s free!)

Hilton Worldwide Holdings is expected to reach $14.8 billion in revenue and $2.5 billion in earnings by 2028. This outlook assumes a revenue growth rate of 45.4% per year and a $0.9 billion increase in earnings from the current $1.6 billion level.

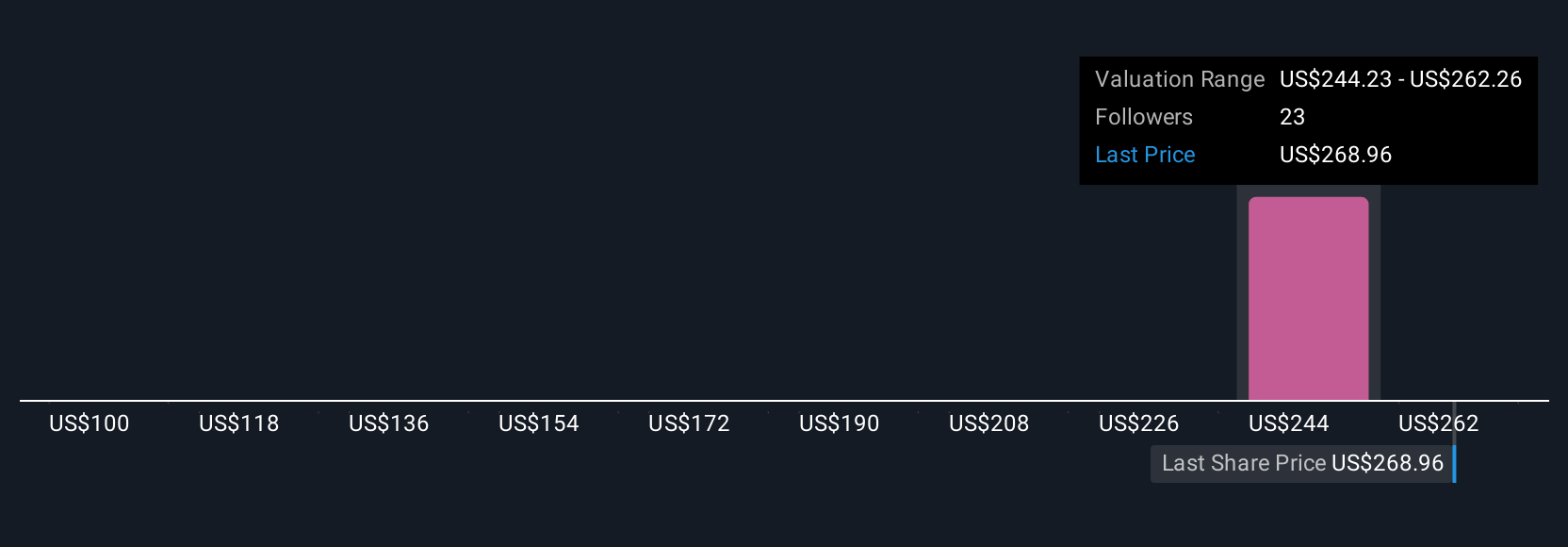

Uncover how Hilton Worldwide Holdings’ forecasts yield a $276.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members put Hilton’s fair value between US$276.00 and US$280.29 per share. While many see brand expansion as a powerful earnings catalyst, others suggest that persistent revenue pressures could weigh on Hilton’s market performance; explore several viewpoints before forming your own outlook.

Explore 2 other fair value estimates on Hilton Worldwide Holdings – why the stock might be worth just $276.00!

Build Your Own Hilton Worldwide Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com