This brief was updated on July 11, 2025 to include the latest KFF polling data.

For many years, KFF polling has found that the high cost of health care is a burden on U.S. families, and that health care costs factor into decisions about insurance coverage and care seeking. These costs and the prospect of unexpected medical bills also rank as the top financial worries for adults and their families. This data note summarizes recent KFF polling on the public’s experiences with health care costs. Main takeaways include:

- Just under half of U.S. adults say it is difficult to afford health care costs, and one in four say they or a family member in their household had problems paying for health care in the past 12 months. Black and Hispanic adults, those with lower incomes, and the uninsured are particularly likely to report problems affording health care in the past year.

- The cost of health care can lead some to put off needed care. About one-third (36%) of adults say that in the past 12 months they have skipped or postponed getting health care they needed because of the cost. Notably three in four (75%) uninsured adults under age 65 say they went without needed care because of the cost.

- The cost of prescription drugs prevents some people from filling prescriptions. About one in five adults (21%) say they have not filled a prescription because of the cost while a similar share (23%) say they have instead opted for over-the-counter alternatives. About one in seven adults say they have cut pills in half or skipped doses of medicine in the last year because of the cost. A third of all adults say they have taken at least one of these cost saving measures in the past year, including larger shares of women and those with lower incomes.

- Health care debt is a burden for a large share of Americans. In 2022, about four in ten adults (41%) reported having debt due to medical or dental bills including debts owed to credit cards, collections agencies, family and friends, banks, and other lenders to pay for their health care costs, with disproportionate shares of Black and Hispanic adults, women, parents, those with low incomes, and uninsured adults saying they have health care debt.

- Those who are covered by health insurance are not immune to the burden of health care costs. Almost four in ten insured adults under the age of 65 (38%) worry about affording their monthly health insurance premium and large shares of adults with employer-sponsored insurance (ESI) and those with Marketplace coverage rate their insurance as “fair” or “poor” when it comes to their monthly premium and to out-of-pocket costs to see a doctor.

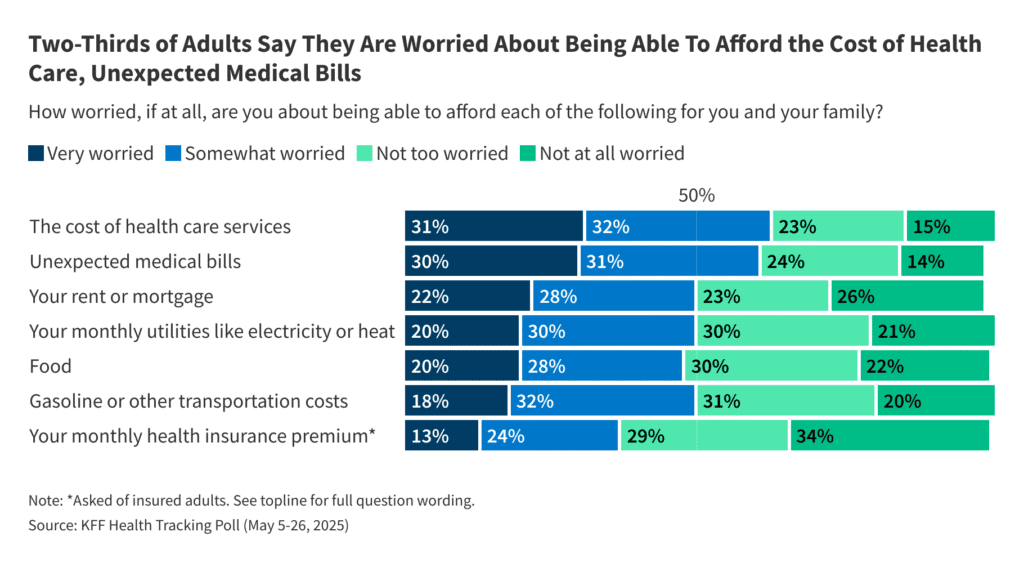

- Notable shares of adults say they are worried about affording medical costs such as the cost of health care services (including out-of-pocket costs not covered by insurance, such as co-pays and deductibles) or unexpected bills. About six in ten adults say they are either “very” or “somewhat worried” about being able to afford the cost of health care services (62%) or unexpected medical bills (61%) for themselves and their families.

Difficulty Affording Medical Costs

Many U.S. adults have trouble affording health care costs. While lower income and uninsured adults are the most likely to report this, those with health insurance and those with higher incomes are not immune to the high cost of medical care. Just under half of U.S. adults say that it is very or somewhat difficult for them to afford their health care costs (44%). Uninsured adults under age 65 are much more likely to say affording health care costs is difficult (82%) compared to those with health insurance coverage (42%). Additionally, a slight majority of Hispanic adults (55%) and half of Black adults (49%) report difficulty affording health care costs compared to about four in ten White adults (39%). Adults in households with annual incomes under $40,000 are more likely than adults in households with higher incomes to say it is difficult to afford their health care costs. (Source: KFF Health Tracking Poll: May 2025)

When asked specifically about problems paying for health care in the past year, about one in four (23%) adults say they or a family member in their household had problems paying for care, including three in ten Hispanic adults (33%) and Black adults (30%). Over half (55%) of uninsured adults under age 65 say they or a family member in their household had problems paying for health care, compared to just one in five (22%) insured adults. (Source: KFF Health Tracking Poll: May 2025)

The cost of care can also lead some adults to skip or delay seeking services, with one-third (36%) of adults saying that they have skipped or postponed getting needed health care in the past 12 months because of the cost. Women are more likely than men to say they have skipped or postponed getting health care they needed because of the cost (38% vs. 32%). Adults ages 65 and older, most of whom are eligible for health care coverage through Medicare, are much less likely than younger age groups to say they have not gotten health care they needed because of cost.

Three-quarters of uninsured adults say they have skipped or postponed getting the health care they needed due to cost. Having health insurance, however, does not offer ironclad protection as about four in ten adults with insurance (37%) still report not getting health care they needed due to cost. (Source: KFF Health Tracking Poll: May 2025)

Skipping care due to costs can have notable health impacts. Nearly two in ten adults (18%) report that their health got worse because they skipped or delayed getting care. Among adults under age 65, those who are uninsured are twice as likely as those with health coverage to say that their health worsened due to skipped or postponed care (42% vs. 20%). About four times as many adults under age 65 (23%) say their health got worse after skipping or postponing care as adults ages 65 and older (6%), most of whom have Medicare coverage. (Source: KFF Health Tracking Poll: May 2025)

A 2022 KFF report found that people who already have debt due to medical or dental care are disproportionately likely to put off or skip medical care. Half (51%) of adults currently experiencing debt due to medical or dental bills say in the past year, cost has been a probititor to getting the medical test or treatment that was recommended by a doctor. (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)

Prescription Drug Costs

The high cost of prescription drugs also leads some people to cut back on their medications in various ways. About one in four adults (23%) say in the past 12 months they have taken an over-the-counter drug instead of getting a prescription filled because of cost concerns and about one in five (21%) say they have not filled a prescription due to the cost. Additionally, about one in seven adults (15%) say that in the past 12 months they have cut pills in half or skipped doses of medicine due to cost.

One-third of the public (33%) say they have taken any of these cost saving measures in the past 12 months. Four in ten women (39%) say they have taken any of these prescription medication measures compared to one-quarter (26%) of men. Additionally, just under half of Hispanic adults (46%) say they’ve either taken an over-the-counter drug, skipped doses, or not filled prescriptions because of the cost, compared to three in ten (29%) White adults who say the same. Similarly, larger shares those with lower incomes report having taken a cost-saving measure in the last year compared to those with higher incomes (41% of those with a household income of less than $40,000 a year vs. 29% of those with an income of $40,000 or more). (Source: KFF Health Tracking Poll: May 2025)

Notably, adults with chronic conditions, who tend to have higher health care and medication needs, can often face challenges affording prescriptions. In KFF’s 2023 Survey of Consumer Experiences with Health Insurance, insured adult with a chronic condition were twice as likely as those without a chronic condition to say they had delayed or gone without prescription drugs due to the cost (18% vs. 9%).

Health Insurance Cost Ratings

Health insurance provides some financial protection, but premiums and out-of-pocket costs can still present a financial burden for many individuals. Overall, most insured adults rate their health insurance as “excellent” or “good” when it comes to the amount they have to pay out-of-pocket for their prescriptions (61%), the amount they have to pay out-of-pocket to see a doctor (53%), and the amount they pay monthly for insurance (54%). However, at least three in ten rate their insurance as “fair” or “poor” on each of these metrics, and affordability ratings vary depending on the type of coverage people have.

Adults who have private insurance through employer-sponsored insurance or Marketplace coverage are more likely than those with Medicare or Medicaid to rate their insurance negatively when it comes to their monthly premium, the amount they have to pay out of pocket to see a doctor, and their prescription co-pays. About one in four adults with Medicare give negative ratings to the amount they have to pay each month for insurance and to their out-of-pocket prescription costs, while about one in five give their insurance a negative rating when it comes to their out-of-pocket costs to see a doctor.

Medicaid enrollees are less likely than those with other coverage types to give their insurance negative ratings on these affordability measures (Medicaid does not charge monthly premiums in most states, and copays for covered services, where applied, are required to be nominal). (Source: KFF Survey of Consumer Experiences with Health Insurance)

Health Care Debt

In June 2022, KFF released an analysis of the KFF Health Care Debt Survey, a companion report to the investigative journalism project on health care debt conducted by KFF Health News and NPR, Diagnosis Debt. This project found that health care debt is a wide-reaching problem in the United States and that 41% of U.S. adults currently have some type of debt due to medical or dental bills from their own or someone else’s care, including about a quarter of adults (24%) who say they have medical or dental bills that are past due or that they are unable to pay, and one in five (21%) who have bills they are paying off over time directly to a provider. One in six (17%) report debt owed to a bank, collection agency, or other lender from loans taken out to pay for medical or dental bills, while similar shares say they have health care debt from bills they put on a credit card and are paying off over time (17%). One in ten report debt owed to a family member or friend from money they borrowed to pay off medical or dental bills.

While four in ten U.S. adults have some type of health care debt, disproportionate shares of lower income adults, the uninsured, Black and Hispanic adults, women, and parents report current debt due to medical or dental bills.

Vulnerabilities and Worries About Health Care and Long-Term Care Costs

KFF’s May 2025 Health Tracking Poll shows the cost of health care services and unexpected medical bills are at the top of the list of people’s financial worries, with about six in ten saying they are at least somewhat worried about affording the cost of health care services (62%) or unexpected medical bills (61%) for themselves and their families. These are larger than the shares who say they worry about affording housing costs (51%), transportation expenses (50%), utilities (49%), and food (48%) for their families.

Notably, eight in ten uninsured adults under age 65 say they are worried about affording the cost of health care services or unexpected medical bills (82% and 80%, respectively). About four in ten (38%) insured adults under the age of 65 say they are worried about affording their monthly health insurance premium. (Source: KFF Health Tracking Poll: May 2025)

Many U.S. adults may be one unexpected medical bill from falling into debt. About half of U.S. adults say they would not be able to pay an unexpected medical bill that came to $500 out of pocket. This includes one in five (19%) who would not be able to pay it at all, 5% who would borrow the money from a bank, payday lender, friends or family to cover the cost, and one in five (21%) who would incur credit card debt in order to pay the bill. Women, those with lower household incomes, Black and Hispanic adults are more likely than their counterparts to say they would be unable to afford this type of bill. (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)

Among older adults, the costs of long-term care and support services are also a concern. Almost six in ten (57%) adults 65 and older say they are at least “somewhat anxious” about affording the cost of a nursing home or assisted living facility if they needed it, and half say they feel anxious about being able to afford support services such as paid nurses or aides. These concerns also loom large among those between the ages of 50 and 64, with more than seven in ten saying they feel anxious about affording residential care (73%) and care from paid nurses or aides (72%) if they were to need these services. See The Affordability of Long-Term Care and Support Services: Findings from a KFF Survey for a deeper dive into concerns about the affordability of nursing homes and support services.